How Do I Know If Venture Capital Fits My Business?

Private equity capital has boomed in recent decades, and many entrepreneurs see it as the end goal when starting up their new ventures. But is it really the silver bullet it’s made out to be? We’ll look into the chances your business has at rising to the heights of Uber and Airbnb and explore some alternative avenues for raising capital and building your next brilliant idea.

There is a popular image in the world of software which many young and inexperienced entrepreneurs are becoming infatuated with. It’s the idea that when you come up with an awesome idea, the highest peak to strive for — the ultimate goal — is getting in front of a venture capitalist and receiving a huge lump sum to propel your business to unimaginable heights and bring tremendous personal wealth. Well then, let’s explore what it really means to fund your business with equity capital.

Helping Those Who Are Unable To Get Funded

Venture capitalism as we know it in the tech industry has many of its roots in that little-known place called Silicon Valley. With the explosive propagation of technology, there was the potential for huge amounts of money making. The capital required to get the full potential out of the new ventures sprouting out of the Valley, was just too large.

In came the VC to fill in the funding gap, offering to fund a company while taking a share of the equity of that company and with it a chance for your idea to see the light of day. This meant ventures with low assets and forecasted cash flows, but with a high growth prospect, could get funded. It was thanks to this highly attractive proposition that the industry grew significantly, in part to startups with groundbreaking innovations and ideas, and with it, private equity funds.

“

The attractiveness of private equity created something of a boom in 90’s when the same excitement seen around the tech industry was being created around the now expanding internet which investors (rightly) saw the potential of.

A new wave of thinking came in with a focus on rapid growth, monopolization of new markets and a disregard of cash flows and profits, and similarly in came the belief that there was an invincibility, that these VC backed internet pioneers could not possibly fail. Of course, they did. The bubble burst in the early 2000’s and the shockwaves were felt throughout the financial markets and investors looked back with embarrassment at their hasty trust in exuberant entrepreneurs. More than half the companies successfully founded in the dot-com bubble were completely wiped off the map, the vast remainder being crippled with hundreds of billions of dollars vanishing into thin air. Only a handful are seen around today a decade or so later.

It’s Almost Inconceivable For A Modern Startup To Skip A Seed Or Series-A Round

But that’s the behind us and can never happen again, right? After all, we’re in a new era of technological growth, social media, handheld and interconnected devices which many an entrepreneur has successfully capitalized upon.

Suppose now that you too have got a great idea (maybe you actually do), you’ve looked up at the likes of Facebook or some other behemoth and been in awe of their success. As a diligent entrepreneur, you’re also consuming a lot of the news and media surrounding the industry and are probably following influencers on LinkedIn and whatnot. From all of this, it’s become very clear to you that if you want to be as big as the best, to take the world by storm and become those influencers you’re following, you’re going to have to go to a VC. It can become inconceivable that you can achieve anything without them in this industry, but it’s not a silver bullet — not by a long shot.

1. Success Rates Are Not As High As You Think

While it may be the case that getting VC investment is the end goal for many fresh-faced entrepreneurs, sadly, one thing skews almost all of these preconceptions of the private equity world, and that’s the bias we attribute to so-called unicorns (> $1B valuations) — your AirBnBs and Ubers which make up less than 1% of successfully seeded companies. The truth is that the majority of investor-backed ventures collapse with failure rates reaching as high as 97% as in the case of hardware startups. This doesn’t necessarily matter too much to the investors who often have large portfolios, but it will matter to you should your startup collapse or trudge onward as a zombie company.

2. You Can Become Heavily Distracted With Seeking Investment, And There’s Such A Thing As Too Much Money Too Early On

Despite these odds, entrepreneurs persevere, leading to one of the largest mistakes an entrepreneur can make, seeking funding in the first place, far too early into the business cycle. The most important thing to any business is the product/service itself, and yet in so many cases, startups would rather spend their time and energy preparing for investment when they could be beginning operations, getting initial feedback from customers and starting to make a name for themselves.

"The amount of money startups raise in their seed and Series A rounds is inversely correlated with success."

In the case of Beepi, a now-defunct used car marketplace, it became clear that they raised far too much, too soon, leading to excessive spending and running the business with no other purpose than to raise money. Entrepreneurs have become so hung up on investment that it can frequently become more important than the product itself.

3. You’re At The Mercy Of The Terms Of Your Investment

If you somehow manage to cobble together an utterly pointless cash flow forecast and business plan — one that will go out of the window as soon as you start operating — or pass through any due diligence the investors undertake, one of the first issues you’ll face is the Term Sheet. This tome of jargon-heavy, legal complexity describes the terms of the proposed investment and dictates the relationship between the investor and you, the entrepreneur.

Ultimately investors, understandably, use it to keep entrepreneurs in check, but it’s often used to keep them on a tight leash and shift much of the executive power away from the founders — potentially changing the direction of the company to a course vastly different to that envisioned at its inception. Mark Billion is a bankruptcy attorney who frequently deals with collapsed, VC-backed ventures and explained that these agreements often try to limit entrepreneurs’ ability to exit and move on, thus limiting their exit strategies. Further yet, in the words of Mark, “There are even instances where the project seems to morph into an almost employer/employee relationship with the VC dictating all aspects of the engagement.”

4. It’s Hard To Reach An Equilibrium, And You Could Be Left Constantly Chasing Further Funding Or Deals To Stay Afloat

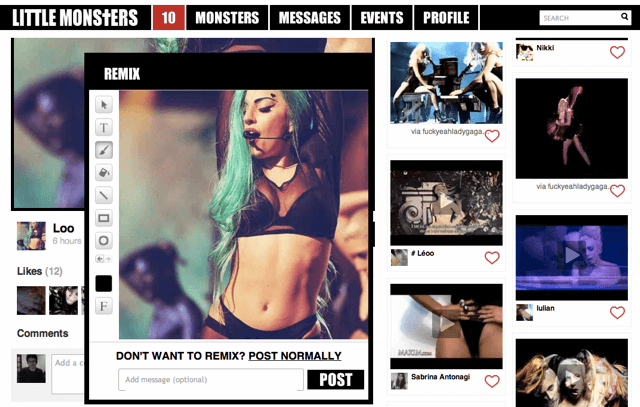

In fact, the terms of investments can be so atrocious that it can even put off other investors, as was the case in the Lady Gaga backed, Backplane, which went bust after raising money at too high an evaluation and with ‘exploitative’ terms on liquidation preferences. This highlights the next issue, which is once you start, you can’t stop. The term “Burn rate” is used to explain how quickly a business is going through its funds, and sadly, due to the sums involved, the burn rates of backed ventures are often astronomical. The lure of rapid scaling (Too soon too fast was RewardMe’s downfall), a lavish lifestyle (Innocent lap dances led to Skully’s demise) and a sense of invincibility from grossly inflated valuations can often leave the company in a fragile state where its chasing one round of investment to another or relying on huge deals to keep them alive and operational for another few months. Sadly, there are all too many cases of ventures collapsing because just one deal fell through.

5. Money Doesn’t Guarantee Success

Many of these issues are touching on the problems of having too much money in some form or another. Whether that’s leading to forced and rapid expansion, excessive spending or some other detrimental side-effect. And it’s true, money doesn’t make a business successful, nor does rapid growth, expansion or millions of users who you can’t monetize. A successful business has to consider customers, the product, the marketplace, cash flows, and lastly, sustainability. In the words of Fred Wilson, a hugely experienced VC and co-founder of Union Square Ventures, “The amount of money startups raise in their seed, and Series A rounds are inversely correlated with success. Yes, I mean that. Less money raised leads to more success. That is the data I stare at all the time.”

Finding What’s Best For You And Your Business

So what can you do? How can you overcome these issues? Well, the first thing to focus on, irrespective of whether you’ll want(or need) VC investment or not, is the product. If possible, create prototypes or if it’s software related, build it yourself! If you can’t create your product, get a splash page up and try to get a user base of people who are willing to register for your newsletter with their email addresses. Get on social media and build a following and go to local tech events to get yourself on the scene and communicating with potential customers and influencers. All of these are things you can do before you have anything built out and ready to use, and can provide you with the perfect opportunity to discuss your idea and build a following around it.

A good number to aim for is 500 people registered to your newsletter ready to use your product come launch day. This will give you a great platform to start up from without having spent a penny on marketing and instantaneous feedback and rapport with your customers. You may not be able to monetize your customers from day one, but from launch, you’ve got to turn your attention to cash flows and try to keep things sustainable for you and the business.

"Whatever you do, however, don’t make the mistake of thinking you can make enough income from ads. It’s simply not feasible and should not be considered a viable business model unless you’re certain you can drive hundreds of thousands of hits in a month. Likewise, in a similar vein, stay away from social media if possible. The market is saturated and like ad-revenue cash-flows come in in drips and drabs."

You may find that people just aren’t interested or don’t think your product is worth what you’re charging. That’s fine; your goal is to adjust to demand and make things sustainable — keep listening to feedback and improving your product.

Only once you’ve sorted out your cash flows, have a good customer base and have refined your product, can you start thinking about investment and growth. And don’t worry, there are many options available to you and alternatives to equity financing.

The first question you should ask is, "Can we grow naturally with our current cash flows?" If you’re lucky enough to be able to answer that with a ‘yes’ turn around, get out of the pitching room and go make your business a success. If the answer is ‘no’, think whether or not you need a VC. Generally, a VC is more likely to be appropriate if you need massive growth with next to no forecasted cash flows, such as products like social media sites. If that’s the case, learn from the mistakes of those VC-backed businesses that failed.

- Keep your burn rate low.

- Stay focused on the product and listen to your customers.

- Aim to make the business financially viable rather than focussing on pure growth.

If you realize you don’t need equity finance, debt financing is good for small cash injections to help spur growth (though be very wary of undertaking debt if your cash flows are not consistently positive) or look to crowdfunding if you need cash without the financial risk. Lastly, some businesses may find that they’re unable to make huge profits because of the nature of their product, or perhaps individuals want to keep their day job while keeping their business as a side project; if that’s the case, consider going open source or crowdsourcing. Both those options can help you to realize your vision, build further rapport with customers and make considerable progress with the product while not having to risk much at all.

Many successful companies operate around a product that is open source, so don’t be put off by the conception that it’s impossible to monetize, because it can be monetized in unique ways. Some businesses have been able to do this through, for example, dedicated hosting of open source software, B2B customer support, and more. One only needs to look at a successful company like Red Hat to see what they're doing, for inspiration.

You may have noticed that raising money from family and friends wasn’t mentioned, and this was deliberate. It goes without saying that family and friends are going to be there for you, and sadly, they’re also going to put you on a pedestal. It’s largely been shown that ventures funded by family and friends have a higher failure rate and this is because they’ve received no external validation.

All of the above recommendations include individuals who can appraise your project and decide whether they want to fund or contribute to your project and while it may require putting yourself out there a little, it can provide invaluable insight into whether other people actually think your idea is a good one. After all, your family will almost always think your ideas are good. Unless of course, they’re really, really terrible.

Keep Yourself Open To Alternative Ways Of Growing Your Business

On a final note, the suggestion here is not that we’re about to experience a private equity bust, or that VC’s are evil and investment will never work for your startup. Instead, entertain the thought that investment is not a silver bullet and shouldn’t be considered the ultimate goal of your new venture. There are plenty of prudent and diligent investors who can help to make your business a success, and likewise, there are many alternatives to equity capital that could work out better for you. You have to find what’s best for you and your business and not fall foul of the misconceptions and reality of the private equity world.

Further Reading

- Crafting A Killer Brand Identity For A Digital Product

- The Feature Trap: Why Feature Centricity Is Harming Your Product

- Why Content Is Such A Fundamental Part Of The Web Design Process

- How To Get Web Design Clients Fast (Part 1)

Start with a free demo —

Start with a free demo — Check the frontend report!

Check the frontend report! Take a break with a 3D game built on Netlify!

Take a break with a 3D game built on Netlify!